How could an unconditional basic income be financed at the macroeconomic level? This is precisely what researchers from the Institute of Economics and Law (IVR) at the University of Stuttgart have investigated in cooperation with the RWI – Leibniz Institute for Economic Research. The Stuttgart-based researchers have also developed an interactive application that shows citizens what effects an unconditional basic income would have on their own households. The application can also be used to simulate other scenarios such as what it would mean for the individual household if the health insurance premiums were increased or there were a tax cut.

The unconditional basic income (UBI) is one of the best-known – but also most controversial – social policy reform proposals and is often discussed as a solution to various socioeconomic problems. The idea of the UBI is that all citizens would receive a financial allowance paid by the state. This would be fixed by law and equal for everyone – regardless of their financial situation. Researchers at the Institute of Economics and Law (IVR) at the University of Stuttgart together with RWI – Leibniz Institute for Economic Research have investigated how a UBI could be financed at the macroeconomic level and how it would affect income distribution.

A UBI could be financed only through major tax hikes.

A key finding of the study is that introducing a UBI that guarantees a livelihood while eliminating social benefits (e.g., unemployment benefits, old age security, and family allowance) would considerably simplify the German social system and greatly reduce the administrative burden. However, compared with the legal status in 2021, state transfer payments would have to be greatly increased. “According to our calculations, public expenditure on a living UBI would be up to EUR 900 billion. Considerable tax increases would be necessary in order to finance this,” says Professor Frank C. Englmann of the IVR.

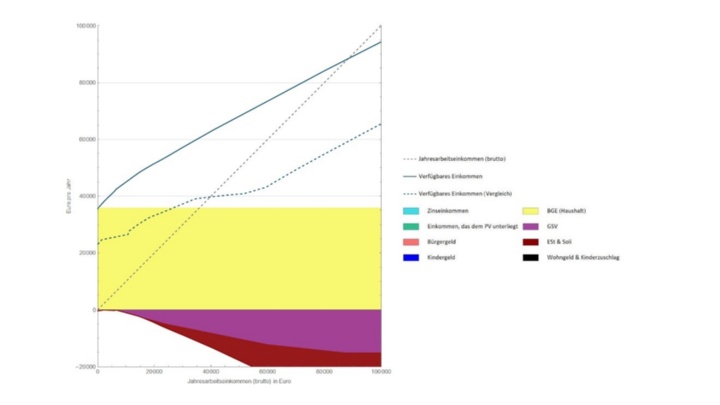

If the state introduced a “flat tax” of 66.1% for all citizens, a UBI of EUR 1,000 per month for adults and EUR 500 for children could be financed. A lower tax rate of 61.2% would be possible if the UBI depended on household size and place of residence. Compared with the status quo, there would be a considerable redistribution. Households in the bottom half of the income distribution would benefit on average – at the expense of the top half. According to the model calculation, in order to finance the UBI with a uniform tax rate of 48%, administrative expenditures in the social welfare system would have to be considerably reduced, and EUR 224 billion would have to be saved elsewhere in the federal budget each year.

Interactive application: What would the introduction of UBI mean for me?

In addition to the issue of general public financing, which was the focus of the study, there are also questions that relate to individual cases. What would the introduction of UBI mean for one’s own household? Using an interactive application, citizens can now simulate this question for their respective individual case. The computer, which already maps the legal year 2023, was developed by researchers at the IVR at the University of Stuttgart.

Simulation of other reform scenarios: How would an increase in the citizen’s income affect household income?

In addition to questions about the UBI, citizens can simulate other questions related to income and the social security system as well as the income tax system. For example, how would an increase in the citizen’s income affect household income? What would it mean for the individual case if health insurance premiums were increased or housing benefits were abolished? And what would be the specific effect if there were a tax increase or decrease?

“With the help of the application, important factors that induce redistribution can be quickly identified. For example, how the number of children in the household affects a reform or which types of households tend to be burdened and which tend to benefit,” explains Prof. Englmann.

The application is based on the software “Wolfram Player”, [DE] and can be downloaded free of charge from the website. Once it is installed, it can be used to open the application. In the compact version of the application, the impact of individual reforms can be analyzed. There is also a detailed version that allows a comparison of two reform scenarios.

Publication:

Englmann, F. C.; Jessen, R.; Bätz, B. et al. (2023): „Ersatz von (ausgewählten) Sozialleistungen und -abgaben in Deutschland durch ein bedingungsloses Grundeinkommen und ein reformiertes Einkommensteuersystem“, http://dx.doi.org/10.18419/opus-12898.

Expert Contact:

For the overall project and expert opinions:

Prof. Dr. Frank C. Englmann (Projektleitung), Institute of Economics and Law, Chair of Theoretical Economics, University of Stuttgart, e-mail

For the interactive application:

Benjamin Bätz, Institute of Economics and Law, Chair of Theoretical Economics, University of Stuttgart, phone: +49 711/685 83540, e-mail

Frank Calisse, Institute of Economics and Law, Chair of Theoretical Economics, University of Stuttgart, phone: +49 711/685 83566, e-mail